-

1 zero-rated supplies

Finin the United Kingdom, taxable items or services on which VAT (Value Added Tax) is charged at zero rate, such as food, books, public transport, and children’s clothes -

2 zero-rated supplies

Englisch-Deutsch Fachwörterbuch der Wirtschaft > zero-rated supplies

-

3 zero-rated goods and services

Finin the United Kingdom, taxable items or services on which VAT (Value Added Tax) is charged at zero rate, such as food, books, public transport, and children’s clothesThe ultimate business dictionary > zero-rated goods and services

-

4 U/I characteristic

внешняя характеристика (источника электропитания)

-

Рис. ABB

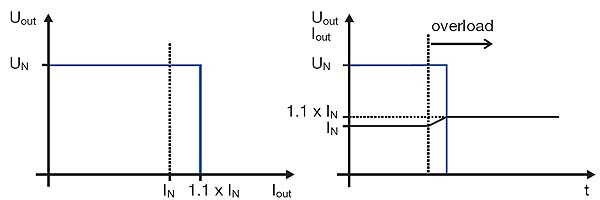

Rectangular current limiting

Рис. ABB

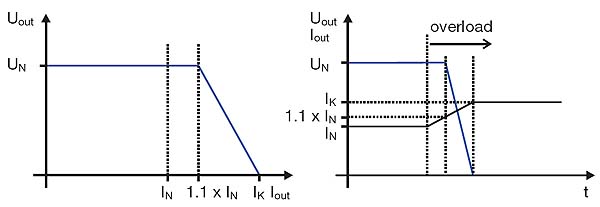

Triangular current limitingPower supplies with a U/I characteristic perform current limiting to typically 1.1 to 1.2 times the rated current at constant output voltage. This current is still available in case of an overload or a short circuit. In this case, the power supply either immediately cuts the output voltage to zero (rectangular current limiting) or performs slow lowering of the output voltage, what, however, can possibly lead to a further increase of the output current (triangular current limiting).

Since the current does not sag in case of an overload, this method enables reliable starting of high loads.

[ABB]Тематики

EN

- U/I characteristic

Англо-русский словарь нормативно-технической терминологии > U/I characteristic

См. также в других словарях:

zero-rated supply — A taxable supply on which value added tax (VAT) is charged at 0%. A person making zero rated supplies is able to recover all of the input tax which is attributable to the zero rated supplies but is not required to account for output tax on those… … Law dictionary

Zero-rated supply — In economics, zero rated supply refers to items that are not charged a tax on their input supplies. The term is applied to items that would normally be taxed under valued added systems such as Europe s Value Added Tax (VAT) or Canada s Goods and… … Wikipedia

zero-rated goods and services — Goods and services that are taxable for value added tax purposes but are currently subject to a tax rate of zero. These include: • certain food items; • sewerage and water services for non industrial users; • periodicals and books; • certain… … Accounting dictionary

zero-rated goods and services — Goods and services that are taxable for value added tax purposes but are currently subject to a tax rate of zero. These include: • most food items, • sewerage and water services for non industrial users, • periodicals and books, • certain… … Big dictionary of business and management

Goods and Services Tax - GST — A Canadian value added tax levied on most goods and services sold for domestic consumption. The tax is levied in order to provide revenue for the federal government. The Goods and Services Tax is paid by consumers, but it is levied and remitted… … Investment dictionary

Value added tax — Taxation An aspect of fiscal policy … Wikipedia

Ad valorem tax — An ad valorem tax (Latin: according to value ) is a tax based on the value of real estate or personal property.An ad valorem tax is typically imposed at the time of a transaction (a sales tax or value added tax (VAT)), but it may be imposed on an … Wikipedia

Goods and Services Tax (Canada) — The Canadian Goods and Services Tax (GST) (French: Taxe sur les produits et services, TPS) is a multi level value added tax introduced in Canada on January 1, 1991, by Prime Minister Brian Mulroney and finance minister Michael Wilson. The GST… … Wikipedia

European Union Value Added Tax — The European Union Value Added Tax ( EU VAT ) is the system of value added tax ( VAT ) adopted by member states in the European Union Value Added Tax Area. The European Union itself does not collect the tax, but member states of the European… … Wikipedia

Taxation in the United Kingdom — This article is part of the series: Politics and government of the United Kingdom Central government HM Treasury HM Revenue and Customs … Wikipedia

tax liability — The amount in taxes a taxpayer to the government. Bloomberg Financial Dictionary Supplies may be standard rated, zero rated, reduced rate or exempt. This is their VAT liability. If supplies are neither zero rated nor exempt, they must be liable… … Financial and business terms